Nayib Bukele (President El Salvador:

"El Salvador's Bitcoin investments are in the black! After literally thousands of articles and hit pieces that ridiculed our supposed losses, all of which were calculated based on Bitcoin’s market price at the time... With the current Bitcoin market price, if we were to sell our Bitcoin, we would not only recover 100% of our investment but also make a profit of $3.620.277.13 USD (as of this moment). Of course, we have no intention of selling; that has never been our objective. We are fully aware that the price will continue to fluctuate in the future, this doesn’t affect our long-term strategy. Nonetheless, it is important that the naysayers and the authors of those hit pieces take back their statements. The responsible thing to do would be for them to issue retractions, offer apologies, or, at the very least, acknowledge that El Salvador is now yielding a profit, just as they repeatedly reported that we were incurring losses. If they consider themselves true journalists, they should report this new reality with the same intensity they reported the previous one. We’ll see… Stay tuned!"

🧡Bitcoin news:

➡️ "Warren Buffett has called Bitcoin "rat poison squared" and stated that "it is an asset that creates nothing". On the 3rd of December, the market capitalization of BTC surpassed that of his company, Berkshire Hathaway." - Mark Harvey

➡️ The president of Colombia met with Samson Mow and Jan3 to discuss how Colombia can adapt. "can be promising for the prosperity of the people."

➡️ Samson Mow, Jan3, and fellow Noderunner Maya told the country's press the Government of Suriname and JAN3, are exploring ways to boost Bitcoin usage. They're even considering converting 1% of the central bank's reserves into Bitcoin. Outcome? A potential safeguard against inflation and a new economic boost.

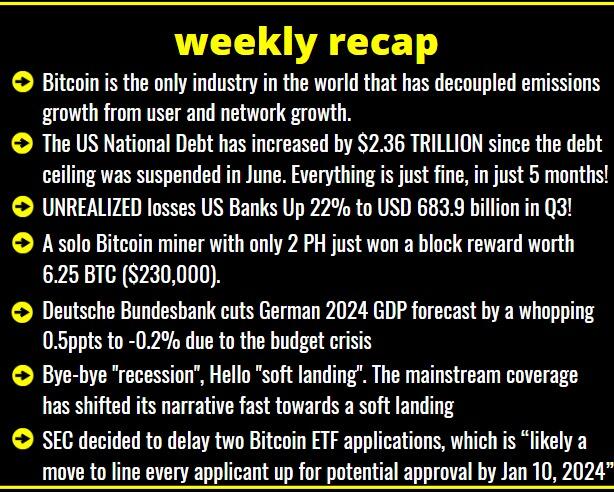

➡️ Over past 4 years:

👉🏽Hashrate ⬆️475%

👉🏽Price⬆️163%

👉🏽Total users⬆️289%

👉🏽Emissions⬇️by -9.4%

Bitcoin is the only industry in the world that has decoupled emissions growth from user and network growth.

➡️Great response by RFK Jr on what brought Bitcoin to his attention "If the government can punish you by shutting down your bank account without even charging you with a crime, they have the ultimate power to turn us into slaves."

Full interview: https://www.youtube.com/watch?v=TceuggOE-EI

➡️$1.5 trillion Franklin Templeton filed an update to its Bitcoin ETF application. After that, the SEC opened a 21-day window for public comment on Franklin Templeton's proposed Bitcoin ETF.

On top of that, the SEC decided to delay two other Bitcoin ETF applications, which is “likely a move to line every applicant up for potential approval by Jan 10, 2024” - Bloomberg ETF analyst James Seyffart

I will quote The Bitcoin Therapist on this one: "The SEC is really about to approve a Bitcoin ETF at the same time the Federal Reserve is about to pivot at the same time the FASB accounting rules will be applied at the same time the halving is about to take place all during a presidential election."

➡️ Jack Dorsey funds a $6.2 million initiative OCEAN to decentralize Bitcoin mining globally with a transparent, non-custodial mining pool.

➡️ A solo Bitcoin miner with only 2 PH just won a block reward worth 6.25 BTC ($230,000). A miner this size solves a block on average only once in every 5 years! Madness

➡️Relai has partnered with Swissquote Bank, the Swiss leader in Online Banking providing online banking and trading services. This partnership means everything from banking to exchange aspects at Relai is now under one roof – 100% made in Switzerland. Swissquote is the perfect partner due to its unparalleled reputation in secure online financial services, aligning perfectly with Relai’s commitment to offering a trustworthy and efficient Bitcoin investment experience.

For more info: https://relai.app/blog/relai-and-swissquote-partnership/

➡️A new working paper co-authored by former ERCOT & NYISO CEO highlights Bitcoin mining as a critical tool for clean energy and balancing the grid.

Abstract: “This review examines the role of Bitcoin mining as a possible catalyst for accelerating the global shift towards clean energy and effective power grid management."

Conclusion: “In the rapidly evolving realm of energy systems and grid management, the significance of DR and flexible load resources is more pronounced than ever. Our review highlights the emergence of Bitcoin miners as a potentially unique and adaptable load category. With their innate interruptibility and swift response capabilities, these miners may offer revolutionary potential for grid flexibility." - Dennis Porter

You can read the full paper here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4634256

In the upcoming days, I will publish my blog post on Bitcoin and energy (mining), so stay tuned.

➡️ If you had invested $50 per day into the following assets over the past 9 years, this is how much you would have:

👉🏽Bitcoin: $4,580,000

👉🏽Tesla: $635,000

👉🏽Dow Jones: $233,000

👉🏽Gold: $222,000

After investing a total of $164,300 over the past 9 years, deciding to DCA daily into Bitcoin was your best decision by an order of magnitude.

➡️Since Halloween, a particular Bitcoin address has amassed 8,674 BTC, equivalent to $323 million. Moreover, they've consistently added 1,000+ Bitcoin to their holdings for the past three consecutive days. This was on the 26th of November.

➡️ "A user recently made headlines for an eye-watering mistake, unintentionally paying a staggering $3.1 million in transaction fees for a transfer worth $2.1 million. On November 23, an unsuspecting Bitcoin user, utilizing the address “bc1qn3d7vyks0k3fx38xkxazpep8830ttmydwekrnl” initiated a transaction to transfer 55 BTC to another address.

However, what should have been a routine transaction took a drastic turn when an astronomical fee of 83 BTC, equivalent to approximately $3.1 million, was attached to the transfer." - BitcoinNews

Always, ALWAYS check the receiving address and the fees.

💸Traditional Finance / Macro:

👉🏽Week ahead: In the US, non-farm payrolls, ISM services, and the University of Michigan sentiment survey. In Europe, it’s the euro area Sentix survey and wage data, the ECB consumer inflation expectations survey, and the UK’s REC Report on Jobs survey. In Asia, with China CPI, Tokyo CPI, and the RBA policy decision

"The S&P 7, also known as the 7 largest tech stocks in the S&P 500, is up a massive 80% in 2023. Meanwhile, the S&P 493, or the remaining 493 companies in the S&P 500, is up just 4%. In other words, the S&P 7 is up 20 TIMES as much as the S&P 7. A few key stocks have become the entire market. The fate of the stock market is in the hands of tech companies and AI hype." -TKL

🏦Banks:

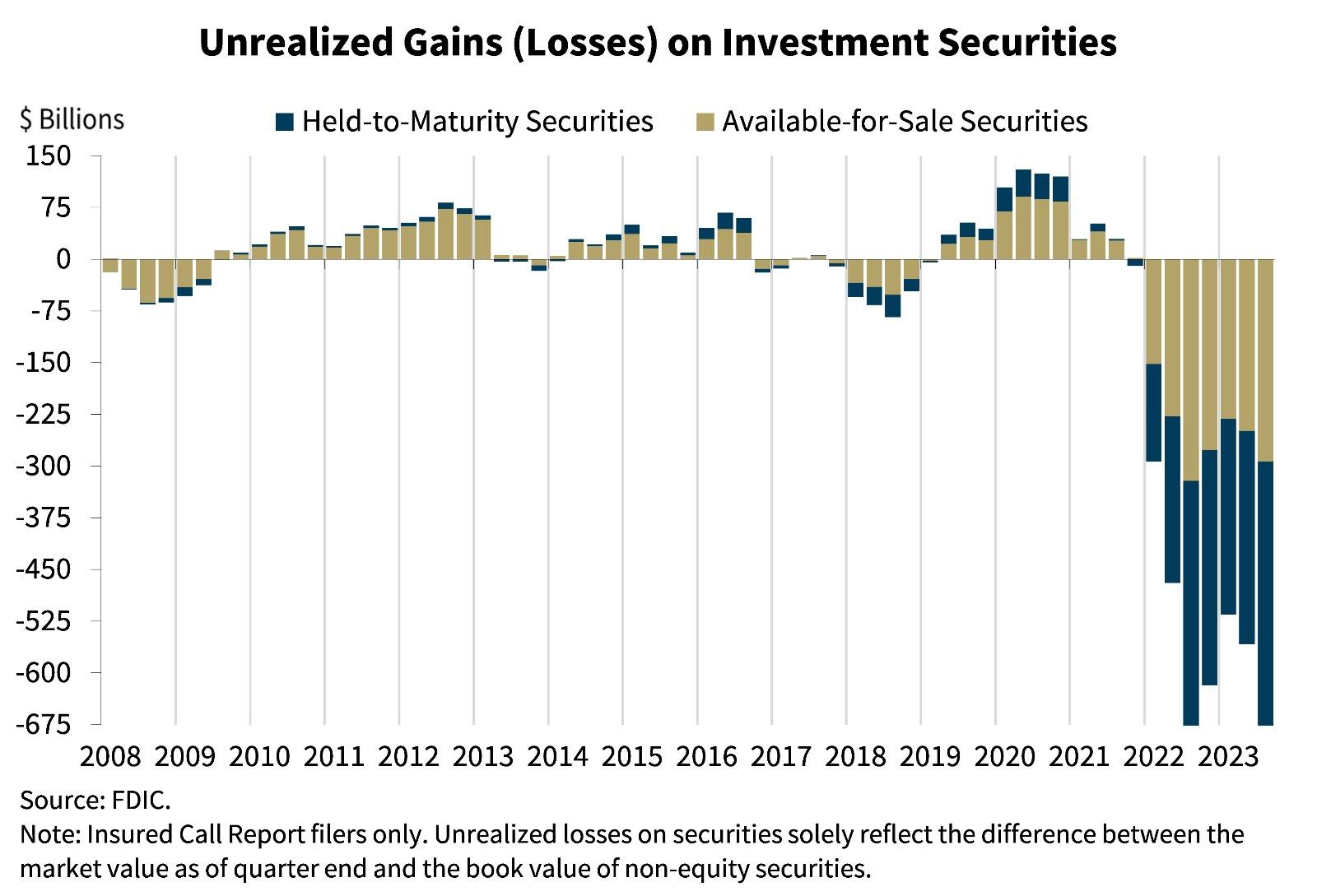

👉🏽UNREALIZED losses US Banks Up 22% to USD 683.9 billion in Q3! We'll need BTFP 2 soon, Jerome. Let's just change it to the Bank Forever Funding Program (BFFP) to make things simpler.

"Unrealized losses on investment securities held by US banks hit $684 billion in Q3, according to the FDIC. This marks a 22.5% jump compared to unrealized losses seen last year. The jump was primarily driven by rising mortgage rates reducing the value of mortgage-backed securities held by banks. Despite these challenges, the FDIC states that banks remain "well capitalized." This comes as usage of the Fed's emergency funding facility for banks hit another record high of $114 billion." - TKL

See picture below.👀

🌎Macro/Geopolitics:

👉🏽The US National Debt has increased by $2.36 TRILLION since the debt ceiling was suspended in June. Everything is just fine, in just 5 freaking months...5!

It’s simple … We use a DEBT-based monetary system. The debt-based monetary system requires that debt always grows. Countries and people must become deeper in debt so that there's more money in the system. More money in the system increases the total money supply. Increased money supply leads to higher Inflation. To have a growing economy we need more DEBT (debt = money *from a different perspective). Having more DEBT = high INFLATION. Using that DEBT system, the INFLATION must go only up.

The US unfunded liabilities today on the 3rd of November just surpassed $212 TRILLION.

Do you get the picture? Opt out; Bitcoin

If you don't believe well listen to what Jamie Dimon (CEO of JP Morgan) has to say on this topic:

Jamie Dimon says: "The U.S is addicted to debt and it’s created a dangerous “sugar high” in the economy. He points to the enormous surge of new debt taken on during the pandemic He says that money is like "heroin" in the hands of consumers "We're on this sugar high and I'm not saying this ends in a depression [but] I think there's more inflationary forces out there…There's a higher chance that rates go higher, inflation doesn't go away, and all these things cause more problems of some sort."

Take this with some salt as Jamie is the heroin dealer in this analogy. You know we're on thin ice in the credit cycle when the pusher starts to complain about the drug he has been the prime beneficiary of, caveat emptor.

But he, Dimon, has been warning of this for some time! Also, Ray Dalio has expressed this for some time.

Oh well, probably nothing. Go on son...watch some sport or Netflix and stay in the rat race called life.

Do you get the picture? Opt out; Bitcoin

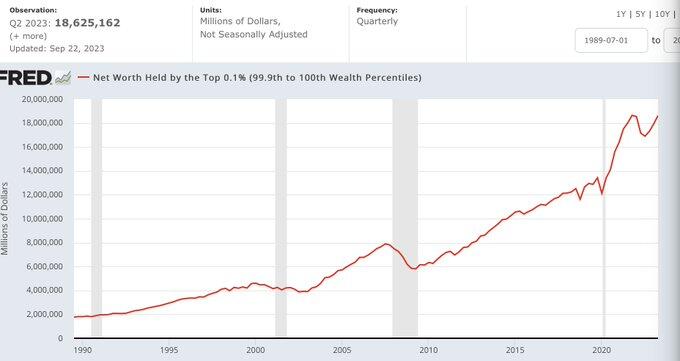

👉🏽 I quote Sam Callahan: "Bloomberg shared some evidence of the cost of living crisis many Americans face today. Since 2020:

Groceries: +25%

Home Values = +42%

Electricity Bills = +25%

Natural gas = +29%

Rent = +20%

Used Car = +35%

Car Insurance = +33%

Child care = +32%

Food at restaurants:

Chicken dishes = +32%

Burgers = +23% Pasta = +14%

Pizza: = +17%

Meanwhile, instead of addressing the problem, the government is worsening it and choosing to gaslight the public by saying this Thanksgiving was the "fourth cheapest ever."

source: https://www.bloomberg.com/graphics/2023-inflation-economy-cost-of-living/

👉🏽"New home prices just crashed by the largest amount on record, down 18% over the last year. According to Reventure, this is the biggest annual decline back to 1965. Even in the worst month of the 2008 financial crisis, the biggest decline was 15%.

The worst part?

New home prices are still up ~24% from their pre-pandemic levels. As mortgage demand hits its lowest since 1994 and affordability is at all-time lows, builders are in trouble. The average selling price for a new home is down almost $90,000 since last year. How can this end well?" - The Kobeissi Letter

👉🏽Deutsche Bundesbank cuts German 2024 GDP forecast by a whopping 0.5ppts to -0.2% due to the budget crisis following the Constitutional Court hearing.

"The state pension is looking increasingly shaky. The federal govt now has to contribute more than €100bn a year. And the fact that the introduction of the so-called equity pension, i.e. the funded pension, has now also been postponed does not make things any easier."

"There was a statement last year by the president of the Confederation of German Employers’ Associations: “Germany’s pension system is “on the verge of collapse. It won’t be financially viable in five years without reform. The costs will explode” Labor shortages, an aging population, and lower productivity - are all material factors for the viability of this system"

Germany is the sick man of Europe. This is going to be a massive issue in so many countries, not only in Germany.

👉🏽"German inflation sinks more than expected as energy retreats & costs of fuels & travel fell sharply from the prior month. Headline CPI slows to 3.2% YoY in Nov from 3.8% in Oct & vs 3.5% exp. Food inflation slowed to 5,5% from 6.1%, Core CPI dropped from 4.3% to 3.8%, so a long way to go to the 2% goal." - Hilger Zschaepitz

👉🏽https://twitter.com/POTUS/status/1726257145551654981

See picture below how that is working.

- Bye-bye "recession", Hello "soft landing" The mainstream coverage has shifted its narrative fast towards a soft landing, which makes me worried ahead of 2024.

👉🏽Nigeria will spend at least six times more on servicing its debt next year than on building new schools or hospitals.

This debt trap has been proudly brought to you by the IMF and World Bank, thanks for the help and playing. You would think that a major oil-production nation like Nigeria could fight out of this debt trap...

If you have made it this far I would like to give you a little gift.

I want to share Michael Saylor's keynote at @labitconf discussing economic wars, the power behind Bitcoin, why Bitcoin is destined to be the apex commodity, technology, property, money, & ETF asset, winning & losing investment strategies, management of counterparty risk, & capital markets digital disruption.

Click on the link and watch the 50min video:

https://twitter.com/saylor/status/1731088400025850201

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.

⠀⠀⠀⠀⠀⠀⠀⠀

Is this post helpful to you? If so, please share it and support my work with sats.

#zap 🧡 #nostr #plebchain #grownostr #stacksats #bitcoineducation #adoption #weeklyrecap