“A democracy cannot exist as a permanent form of government. It can only exist until the voters discover that they can vote themselves largesse from the public treasury. From that moment on, the majority always votes for the candidates promising the most benefits from the public treasury with the result that a democracy always collapses over loose fiscal policy, always followed by a dictatorship. The average age of the world's greatest civilizations has been 200 years. These nations have progressed through this sequence: From bondage to spiritual faith; From spiritual faith to great courage; From courage to liberty; From liberty to abundance; From abundance to selfishness; From selfishness to apathy; From apathy to dependence; From dependence back into bondage.”

― Alexander Fraser Tytler

🧡Bitcoin news🧡

➡️On the 16th of March, we received the news that $88m leveraged Bitcoin positions were liquidated in 24 hours.

Losing money in a bull market…REKT.

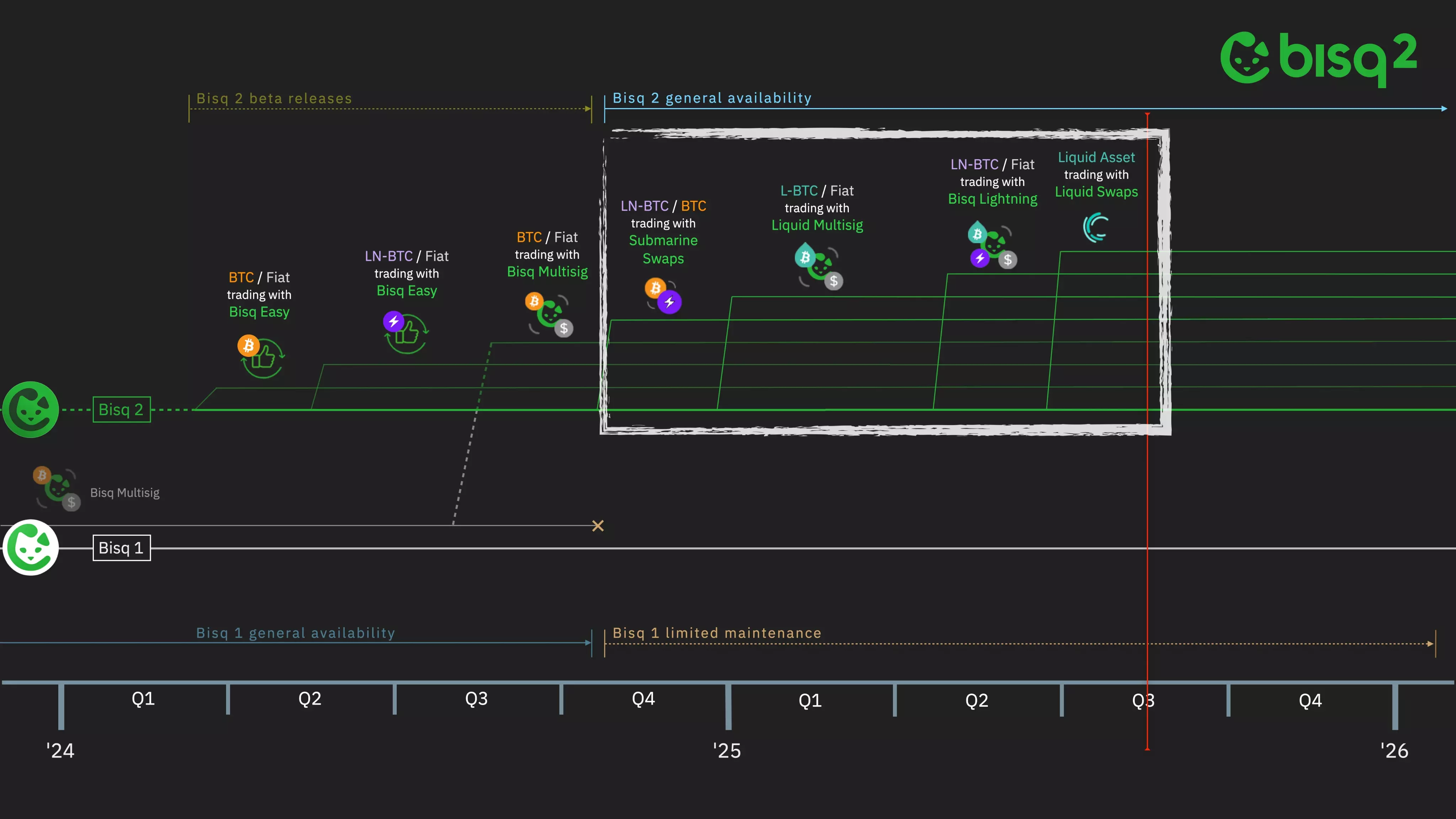

➡️"The first Bisq 2 beta release is now available. Interested?

Watch http://bisq.network/bisq-2 and:

1. run Bisq 2;

2. trade with Bisq Easy (or lurk while others do);

3. give feedback in the new p2p group chat." - Bisq

I always recommend Bisq as one of the primary peer-to-peer market on-ramps to Bitcoin (for the more advanced users). So I am very excited to see the roadmap and look forward to the development and use of version 2. (picture 4)

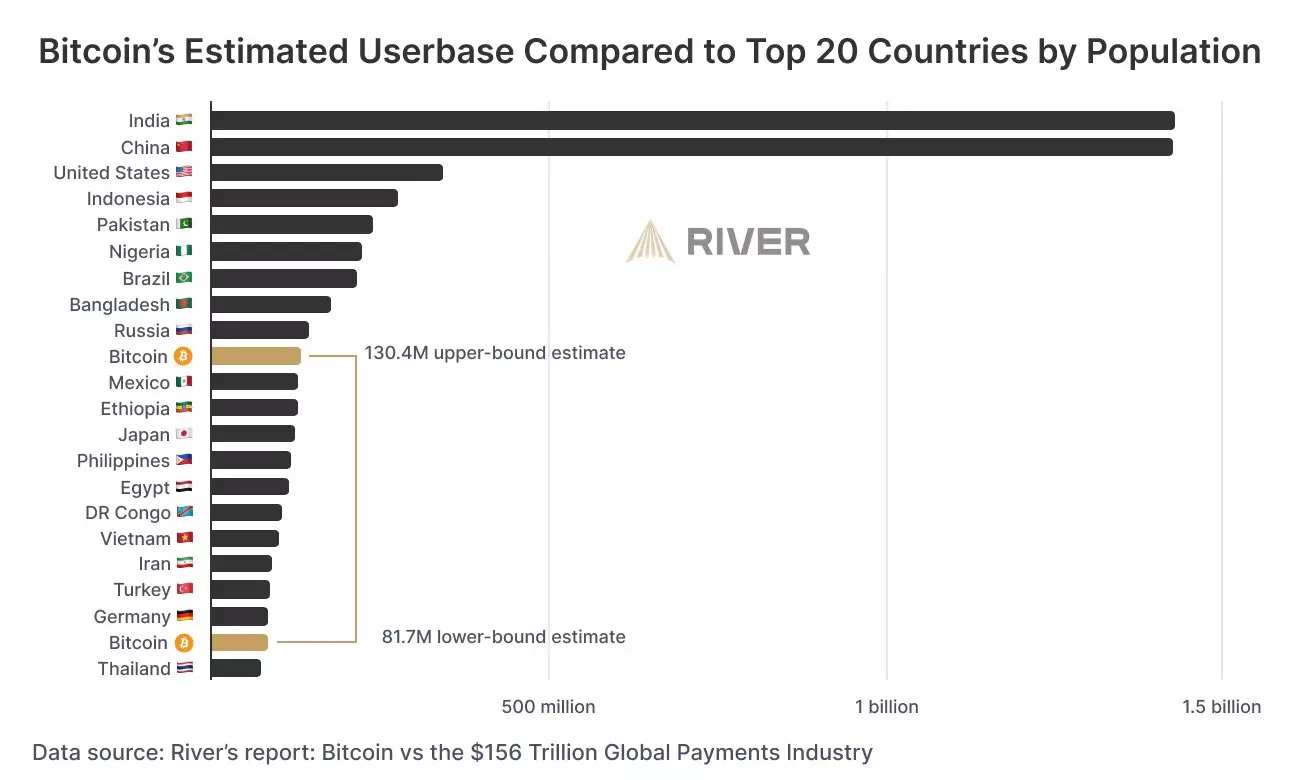

➡️"If Bitcoin was a country, it would rank somewhere between 10-20 in population size.

Something tells me we're going to enter the top 10 very soon." - Sam Wouters (picture 2)

Source: https://river.com/learn/how-many-people-use-bitcoin/

➡️The US government is still holding seized Bitcoin equivalent to ~1% of the total supply with a 2.4X unrealized profit. They haven’t sold any since July 2023 when Bitcoin was $30K.

➡️The Bitcoin network is projected to settle $17.5 trillion worth of BTC this year.

➡️Bitcoin Network Difficulty sets a new ALL-TIME HIGH of 83.95 T

This is nearly double the reading from one year ago (43.55 T) The global competition to mine

Bitcoin continues to heat up.

➡️New Record Bitcoin Hashrate 600,000,000,000,000,000,000x per second

➡️Wealth advisor platform Cetera just approved Bitcoin ETFs to be offered to clients.

It has $475 billion in assets under administration and $190 billion in assets under management.

➡️ $7.2 trillion Vanguard CEO Tim Buckley says they're not going to offer spot Bitcoin ETFs "unless the asset class changes."

"Bitcoin is just too volatile and it's not a store of value."

➡️“Mr. 100” bought 810 of the 900 newly mined Bitcoin on the 14th of March, so the ETFs had to find other willing sellers.

➡️On the 13th of March, we had the first $1B inflow day into the Bitcoin Bitcoin ETFs. Madness! And BlackRock's Bitcoin ETF total inflows overtook Grayscale's total outflows for the first time! You are simply not bullish enough.

Really... you are not bullish enough: https://www.zerohedge.com/crypto/bitcoin-has-6-months-until-etf-liquidity-crisis

➡️Last week I mentioned that VanECK announced they cut their management fee to ZERO until March 2025. Their Bitcoin ETF doing HUGE trading volume a day after.

https://twitter.com/BTC_Archive/status/1767596983026364663

➡️"Blackrock Bitcoin Inflows

34.6K Last Week

31.4K The Week Before

34.3K The Week Before That

Any wild guesses about how much they buy this week?"

➡️ El Salvador will be able to pay off the IMF if Bitcoin hits $100K, and never have to talk to them again.

They’ll probably be the most attractive country in the world to go live in just because they embraced

Bitcoin,” says billionaire Tim Draper.

More news on El Salvador: El Salvador voted to drop their income tax from 30% to 0% for money transfers and international investments.

Oh, by the way, El Salvador’s President, Nayib Bukele :

“Your TAX money is NOT funding your government.

Your government is funded by printing money out of thin air.

So, if your central bank is printing money to fund the government, then WHY do we need to pay taxes?"

Now to make things extra special...

On the 15th of March, Nayib Bukele announced that they decided to transfer a big chunk of our Bitcoin to a cold wallet and store that cold wallet in a physical vault within our national territory.

You can call it our first Bitcoin piggy bank. It's not much, but it's honest work.

https://twitter.com/nayibbukele/status/1768425845163503738

Pretty incredible to see a President tweeting about Bitcoin nation-state self-custody. And what do plebs do? El Salvador released its Bitcoin cold wallet address & you psychopaths are sending donations. Classic.

Just a thought...If El Salvador can be transparent with their reserves why can’t the United States government or the ECB/Central Banks?

Why can’t we see the gold?

➡️El Salvador President Nayib Bukele says the country will purchase one Bitcoin every day until it becomes unaffordable with fiat currencies.

➡️ On the 12th of March Relai 🇨🇭 (npub1sqz…vk7v) rolled out their lightning functionality within the app.

100,000 Relai users now have access to ultra-fast and cheap Bitcoin transactions.

Why Lightning? "The Lightning Network has quickly emerged as the go-to scaling solution for the Bitcoin network. Not only is it great to use Bitcoin in everyday situations, such as paying for a cup of coffee or goods in a shop, but it’s also incredibly fast and much cheaper compared to on-chain transactions."

Relai: "We do this by working closely with two amazing Bitcoin companies! One is our node and implementation provider, Blockstream. We use their Core Lightning implementation, which allows us to be flexible with other Lightning setups as well as using their node. Our second partner is Breez, with their SDK. This provides us access to a wide range of Lightning Service Providers (LSPs) and partners in the network."

Just update your app. To use Lightning, you need to update to the latest version 2.8.1.

Not using Relai at the moment? Download the app https://relai.app/, use the code CRYPTOFRIDAY, and get a 0.5% fee reduction on your weekly/monthly Bitcoin purchases.

➡️Michael Saylor says Bitcoin is going to "eat" gold and has all the great attributes of gold.

All the reasons why Bitcoin will demonetize Gold:

"-Gold was the money of the analog world, and Bitcoin is the money of the Digital World, it is superior in every way for a digital age.

-Precious metal markets have been highly manipulated for a long time.

-Elastic Supply unlike Bitcoin's inelastic supply

-Alleged rehypothecation of precious metal paper contracts (The paper price of Gold) artificially increasing supply.

-Price action has been slow and tedious, with low gains for the last 10 years.

-Much Harder to store and secure

-Much Harder to Transport

-Can be counterfeited in some circumstances

-Unprogrammable

-Centralised"

➡️Bitcoin’s allocation in investor portfolios is 3.7 times greater than that of gold, according to JP Morgan analysts.

➡️On the 11th of March, "Bitcoin just bumped silver to become the 8th most valuable asset in the world.

All else held equal...

at $105K, it jumps Saudi Aramco,

at $137K, it enters the top 3,

and at $153K, Bitcoin becomes the second most valuable asset in the world." - James Lavish

➡️The new Biden budget proposal plans to bring in more than $2.3 billion in the next five years by taxing bitcoin miners.

Biden expects the Bitcoin mining industry to 10x in the United States over the next decade, this would imply a $6 million price target for Bitcoin. Even more bullish than the wash trading line item.

American dynamism and energy abundance will make this possible!

The 30% tax is just absurd. This must be stopped at all costs.

First read the following tweet: https://twitter.com/BitcoinPierre/status/1767371855512432900

Talking about Biden, check out their budget for fiscal year 2025 below, segment macro.

➡️In ~32 days, Bitcoin becomes the hardest asset known to man, with its supply growth rate dropping to half that of gold. This will be Bitcoin's biggest and most important Halving ever. Are you ready?

➡️Merryn Webb, a Senior Columnist at Bloomberg, REFUSES to interview Adam Back, one of the few people ACTUALLY cited in the Bitcoin whitepaper, simply because he has LASER EYES in his X (formerly Twitter) profile picture.

Mainstream media at his finest! (picture 5)

➡️Just a reminder that the FTX bankruptcy estate has 58 million Solana tokens to sell, which is over 13% of the total Solana supply, or about 8.5 billion dollars in today's prices.

➡️The owner of the largest exhibition venue in the Middle East, Abu Dhabi’s ADNEC Group, is to launch the region's first Bitcoin MENA Conference set to take place December 9-10 2024.

💸Traditional Finance / Macro:

What can you expect this week in the traditional financial market?

Main highlight ahead:

In the US, we have the Federal Reserve meeting and press conference with Fed Chair Powell. In the UK, we have the Bank of England meeting and CPI data, and in Europe, the latest ZEW surveys and several ECB speakers. In Asia we start the week with a key policy meeting at the Bank of Japan, more central bank meetings in Indonesia, Taiwan, and Australia, and monthly activity data for China.

🏦Banks:

👉🏽Powell: ‘There will be bank failures’ caused by commercial real estate losses

But not the really big banks, he promises, those will be fine.'

https://thehill.com/business/4516758-powell-there-will-be-bank-failures-caused-by-commercial-real-estate-losses/

🌎Macro/Geopolitics:

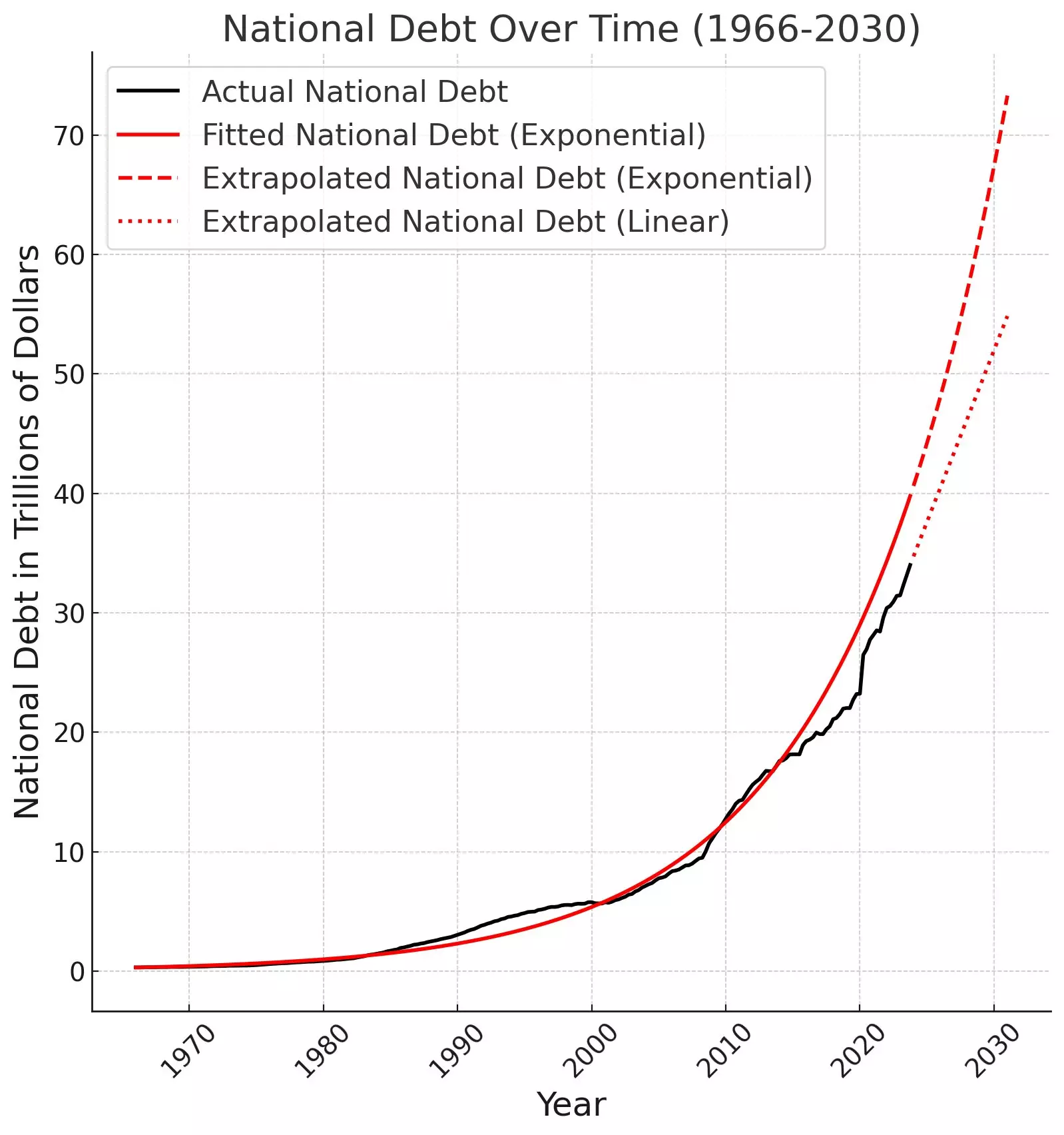

👉🏽"BIDEN UNVEILS $7.3 TRILLION BUDGET FOR FISCAL YEAR 2025, THE BIDEN BUDGET SEES US DEBT HITTING $45 TRILLION IN A DECADE" was the headline.

Just absurd, that the Biden administration thinks that the US DEBT will hit $45 trillion in a decade.

None of their models now or in the past, and recent years came through. We're at nearly $35 trillion now with a new trillion added every 100 days.

You know what is even more absurd and I quote Brian Sullivan: "DC strategist email note this morning lays it out well.

The budget deficit will grow another $16 TRILLION over the next 10 years. That *with* the proposed massive tax hikes.

Without them, the deficit will grow by $19 trillion.

That's why you will hear the "deficit is being reduced by $3 trillion" over the decade.

No family budget or business could exist with this kind of math."

Balaji: "Linear extrapolation gives $50 trillion.

Exponential is more like $70 trillion.

And Bitcoin remains at 21 million."

(picture 3)

Source: https://fred.stlouisfed.org/series/GFDEBTN

Oh, just to make things worse, it took 63% of all personal income taxes in Feb to pay the interest on the debt - no roads, no military, no schools, no social security - JUST INTEREST.

👉🏽On the 12th of March US CPI came in.

The 'hot' CPI prints show that headline inflation is sticky around the 3% level.

"On a 3-month annualized basis, Supercore inflation jumped a whopping 6.9% in February.

Core services less shelter inflation is a key metric that the Fed follows, also known as Supercore inflation.

In January, this metric jumped by 0.7% month-over-month, the biggest jump since September 2022.

In February, it was up another 0.5% month-over-month after multiple increases in 2023.

All while real wage growth is turning negative again.

In general February CPI inflation rate RISES to 3.2%, above expectations of 3.1%.

Core CPI inflation fell to 3.8%, ABOVE expectations of 3.7%.

This is the 35th consecutive month with inflation above 3% and the second straight increase.

The fight against inflation is far from over." -TKL

👉🏽"Prediction markets are officially expecting LESS than 3 interest rate cuts in 2024.

After CPI inflation increased for the 2nd straight month, prediction markets saw 65 bps of rate cuts in 2024, according to Kahlsi.

This is equivalent to ~2.6 rate cuts and down SHARPLY from 6 rate cuts seen just 2 months ago.

It's also the first time this year that markets see LESS rate cuts than Fed guidance.

Core inflation is still at 3.8%, nearly DOUBLE the Fed's long-term target.

Could we see ZERO rate cuts in 2024?" -TKL

Still up only, especially in a year when we have a presidential election in the US.

Do you want to know more about the rates bit, please read the following tweet by Luke Gromen:

https://twitter.com/LukeGromen/status/1767556897626898876

👉🏽"For the first time in history, interest payments on non-mortgage debt in the US are equivalent to interest on mortgage debt, at $575 billion.

Exactly 3 years ago, interest on non-mortgage debt was at $250 billion.

This marks a 130% increase in household interest expense on non-mortgage items over just 3 years.

Furthermore, 3 years ago interest on non-mortgage debt was HALF of interest on mortgage debt.

Americans are "fighting" inflation with high interest-rate debt.

36% of US adults have more credit card debt than money in a savings account.

Also, the average American household owes $7,951 in credit card debt.

As rates rise, the pain of this debt is getting even worse.

How is this sustainable?" - TKL

👉🏽"ECB plans to roll out digital Euro CBDC starting in 2025. They claim it’ll be “private,” but it will not be, given Lagarde already wants to throw you in jail for a 1000+ euro anonymous cash payment.

Study Bitcoin & opt out of this totalitarian surveillance token." -WalkerAmerica

https://www.ecb.europa.eu/press/key/date/2024/html/ecb.sp240313~f632c531ac.en.pdf?c399660b02271b5ec70ef86e839a8c64

👉🏽"KPMG study among the 350 CFOs of the largest German subsidiaries of international groups shows that there is record-high skepticism with respect to Germany as an investment destination

Foreign investors are pessimistic and the attractiveness of the country is at risk: 46% of respondents believe that other countries and regions are growing faster than Germany and intend to prioritize investments there in the next five years

Energy transition, digitalization, upgrades, and infrastructure have opened up great business opportunities for international companies, but

all location factors are deteriorating with increasing momentum." - Nikolay Kolarov

In the past year, I have spoken on the deindustrialization of Germany multiple times. Everyone is aware of German deindustrialization by now, unfortunately, industrial production in other major European countries is not looking much better.

(picture 6)

(picture 7)

👉🏽Goldman points out that the Turkish central bank is about to lose control as "FX position deteriorates sharply". Is the Turkish lira on the verge of terminal collapse?

🎁If you have made it this far I would like to give you a little gift:

Another great What Bitcoin Did podcast.

The Perfect Bitcoin Allocation with Raphael Zagury

- Bitcoin vs real estate

- How ETFs changed everything

- Valuing Bitcoin

- The best portfolio allocation

https://www.youtube.com/watch?v=hqsGIRhFkvM

Anyway, that's it for today.

Only invest in Bitcoin what you can’t afford to have gradually stolen from you by the government.

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. #zap 🧡 #weeklyrecap #nostr #plebchain #BTC #Bitcoin #zap🧡 #plebchain #grownostr #stacksats #bitcoineducation #adoption