"Imagine working 9-5 for 50 years then The Fed prints 40% of the total money supply and inflates away 20 years of your work."- BTCforFreedom

"Freedom of speech becomes impossible through the incentives of manipulated money!

(regardless of who benefits from said manipulation tells you)

#Bitcoin

Stealing productivity gains (via inflation) that should flow to society in the form of lower prices is the root cause." -Jeff Booth

"In the coming bull run, just about everybody in "crypto" will take credit and revel in the price of Bitcoin. They'll try to trick you by showing you this "other" coin that will do the same thing. This is called affinity scamming, and there are a lot of people who have positioned themselves over the last 4 years to do exactly that.

Save yourself the heartache and go Bitcoin only." - Jimmy Song

🧡Bitcoin news🧡

➡️After seven weeks, Bitcoin falls below $40k and…. no one cares just keep stacking.

Now what is the reason why Bitcoin is dropping?

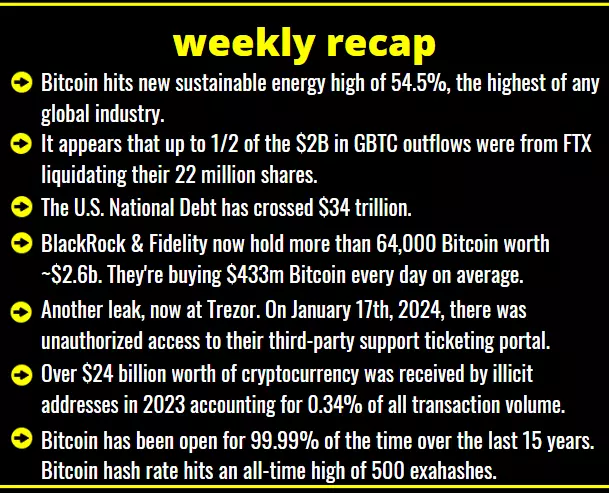

➡️According to reports from CoinDesk, it appears that up to 1/2 of the $2B in GBTC outflows were from FTX liquidating their 22 million shares.

In addition, FTX's sister hedge fund Alameda Research voluntarily drops its lawsuit against Grayscale Investments on the 22nd of january.

Ergo, blame FTX...again!

"It looks like the majority of Greyscale's (GBTC) outflows were not due to its higher fees, but rather due to a legal obligation of bankrupt FTX to liquidate its holdings.

I'll say it again. I suspect with most FTX redemptions out of the way, GBTC outflows will come to a trickle by the end of the month, retaining their kingship of the spot

Bitcoin ETF space by an enormous margin." -Oliver L. Velez

(picture 3)

➡️BlackRock & Fidelity now hold more than 64,000 Bitcoin worth ~$2.6b. They're buying $433m Bitcoin every day on average.

in total 9 Bitcoin ETFs now hold +95,000 Bitcoin worth ~$4 Billion.

Bitcoin ETFs had $17.2b in trading volume in just 6 days.

➡️Bitcoin hits new sustainable energy high of 54.5%, the highest of any global industry:

"Sustainable energy use for Bitcoin (BTC) mining reached an all-time high of 54.5% in 2023, a 3.6% increase throughout the calendar year.

The analysis, conducted by The Bitcoin ESG Forecast, compared Bitcoin’s sustainable energy mix to other industries using publicly available data over the past four years. Furthermore, the industry has made notable progress in increasing its reliance on sustainable energy sources, surpassing other global sectors."

The results indicate that Bitcoin mining currently ranks as the largest consumer of sustainable energy among subsectors. (picture 2)

➡️https://twitter.com/LNMarkets/status/1749387083620257990

LN Markets is killing it! Great volume, incredible achievement!

➡️Bitcoin has been open for 99.99% of the time over the last 15 years.

➡️In full-on dumping mode, Bitcoin miners sold over 10,000 BTC alone on January 17. It marked the biggest daily decline in miner reserves in over 12 months.

Bitcoin miner reserves are at their lowest levels since July 2021.

➡️Bitcoin Whale sells 59K $BTC, purchased 3-6 months ago at an average price of $26K. This could be anyone...profit taking by any major party such as BlackRock etc. as they speculate on the selling of GBTC. (grayscale)

➡️Bitcoin hash rate hits an all-time high of 500 exahashes.

➡️Bitcoin network difficulty drops -3.90%, the largest negative correction since December 5, 2022, amid curtailments of Texas miners due to extreme cold conditions in the Lone Star State.

➡️ Another leak, now at Trezor. On January 17th, 2024, there was unauthorized access to their third-party support ticketing portal. The security incident has implications for customers who have interacted with Trezor Support since December 2021. Based on the ongoing investigation of the incident and the communication with the third-party service provider there is a potential that the contact details of up to 66000 users, customers who have interacted with Trezor Support since December 2021, may have been accessed.

TLDR: Of course, this can happen to everyone. But for the love of god start using Bitcoin-only hardware wallets.

Blockstream Jade

Bitbox 02 - Bitcoin only

Foundation Passport

➡️Over $24 billion worth of cryptocurrency was received by illicit addresses in 2023 accounting for 0.34% of all transaction volume,

Chainalysis has been estimated.

Now ask yourself, why do we need new AML/Money laundering rules and laws, like for example MiCAR or the new anti-crypto law by Senator Warren?

2-5% of traditional finance is estimated to be used for illicit transactions according to the UN. It's the fiat system that facilitates corruption...

➡️$2 Billion of dormant Bitcoin was moved for the first time since 2019. It had only moved once since 2013. - Arkham Intel

➡️Great tweet by Daniel Batten. "By investing in Bitcoin you support:

1. The profitability of renewable energy.

https://news.cornell.edu/stories/2023/11/bitcoin-could-support-renewable-energy-development…

2. the mitigation of methane, our #1 lever to slow climate change.

https://planb.lugano.ch/why-bitcoin-is-the-worlds-best-esg-asset/…

3. The world's least emission-intensive financial instrument.

➡️HODLers are not selling

The HODL Waves chart shows the amount of Bitcoin held for different periods. Long-term holders (see blue arrows - 1yr+ & 6mo+) have NOT sold any BTC to ETFs

(picture 1)

💸Traditional Finance / Macro:

👉🏽The S&P 500 has officially hit a new all-time high for the first time in 2 years.

All 3 major market indices are now in all-time high territory.

An all-time high in fiat terms...in BTC...oh well, just have a look at the picture.

(picture4)

The S&P 500 is now 11% higher than where it was when the Fed started hiking rates in March 2022. Serious disconnect between the traditional financial markets and the economy.

"Owning an SP500 fund is no different from holding a tech ETF.

The top 7 components are all tech companies and represent 26% of its holdings.

SPX should no longer be viewed as a diversification instrument. It’s no longer spreading risk across 500 companies to protect you."

🏦Banks:

👉🏽https://twitter.com/JoeConsorti/status/1748133433761526134

Powell & Co. are planning to FORCE all banks to utilize emergency credit so that the market can’t tell safe banks from distressed banks. For me, the above tweet and the ramifications of that FED rule are yet another sign of the upcoming (necessary event) collapse/recession. They, the FED, did a similar thing in 2007.

In the end, the banking industry is set to consolidate. (picture 5 cash banks)

🌎Macro/Geopolitics:

"The Fed's cumulative losses are nearly $140 billion now, and continuing to grow.

It doesn't really affect the Fed, but it adds to the fiscal deficit. The Fed used to be a profit source for the Treasury.

Now, its operating losses keep digging it into a hole, so no profits flow to the Treasury. The Fed has to once again turn profitable and pay back its cumulative losses before it would resume sending profits to the Treasury".- Lyn Alden (foto)

Meanwhile, the U.S. National Debt has crossed $34 trillion. That’s $102,719 for every single person in America.

👉🏽When asked what is the purpose of his trip to Davos, Javier Milei responds: "Planting the ideas of freedom in a Forum that is contaminated by the Socialist Agenda 2030 will only bring misery to the world."

"As we kick off 2024, the US has already added another ~$200 billion in Federal debt over the last 3 weeks.

This puts annual interest expense on track to hit $1.05 trillion.

To put this in perspective, annual interest expense was less than $500 billion just TWO YEARS ago.

As interest rates rise and deficit spending soars, interest expense is becoming one of our largest costs." - TKL

Ergo: Kicking the can down the road...as usual. With trillions of dollars of debt set to mature in the next 12 months, along with $2 trillion-plus of deficit spending likely for fiscal year 2024, and with the trough of the yield curve now the 5-yr UST bond at 4.04%, interest expense is likely to go much higher.

👉🏽"For 1st time in almost 30 years, China’s GDP in $ fell in 2023 to about $17.5trn, while U.S. gdp rise 6% to about $27trn. The gap widened by about $2trn. And China’s share of world GDP slipped to just under 17%. China's real GDP is now further below its pre-COVID trend than after the 2008 crisis. China will inevitably export its weak domestic demand to the rest of the world via rising current account surpluses and deflation."

China is contemplating issuing 1 trillion yuan ($139 billion) in new debt through a special sovereign bond plan, marking only the fourth such sale in 26 years

The Middle Kingdom appears to be warming up the money printer.

Talking about liquidity:

👉🏽"Money market funds just saw $182 billion of inflows in the first 2 weeks of 2024.

This is the biggest 2-week inflow ever recorded to start a year.

This brings the total assets held by money market funds up to a record $6 trillion.

Since the Fed began raising rates in March 2022, over $1.5 trillion has gone into money market funds.

Now for the trillion-dollar question.

Where does all this capital go once the Fed starts cutting rates?" - TKL

Maybe we can find the answer in the following statement:

👉🏽The top 0.1% (132,000 households) have a combined net worth of $20 trillion.

The bottom 50% (66,000,000 households) have a combined net worth of $3.6 trillion.

The wealth gap keeps widening to ever more extremes with each intervention cycle.

https://twitter.com/NorthmanTrader/status/1747257006497706458

👉🏽 https://twitter.com/DylanLeClair_/status/1748012214794006802

Bingo: Opt Out Bitcoin

The world has now access to the hardest assets in human history.

👉🏽https://twitter.com/Schuldensuehner/status/1748984398135906365

"Why Germany is rich but Germans are poor and angry. Germany’s grossly unequal distribution of wealth is contributing to the country’s malaise. The median household in Germany has just €107k of net assets, while the wealthiest 10% have at least €725k. Reconciling the Free Democrats’ anti-borrowing philosophy w/Social Democrats’ commitment to welfare spending & the Greens’ determination to promote decarbonization has led to bickering & compromises that satisfy almost nobody." - Holger Zschaepitz

https://www.bloomberg.com/opinion/articles/2024-01-15/why-germany-is-rich-but-germans-are-poor-and-angry

🎁If you have made it this far I would like to give you a little gift:

"The focus on security and decentralization is largely what makes Bitcoin different from other cryptocurrency networks"..."Bitcoin is competing in the global marketplace of monies."

Good article for people who don't understand investing in Bitcoin:

https://www.lynalden.com/bitcoin-network-health/

Free knowledge!

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. #zap 🧡 #weeklyrecap #nostr #plebchain #BTC #Bitcoin #zap🧡 #plebchain #grownostr #stacksats #bitcoineducation #adoption